Sylvan ESGI Integrated Investment Process

Sylvan ESGI Integrated Investment Process

At Sylvan, we consider ESG factors as potential risks in the operations and underlying businesses of our investee companies. They can result in poor investment returns if they are not properly managed.

On the other hand, impact factors are investment opportunities aligned with Sylvan’s mission. We believe ESGI integration will contribute to solving important problems the world faces, and ultimately enhance our long-term returns. Therefore, investment teams have a responsibility to identify ESGI risks and opportunities and examine positive/negative impacts on performance.

As well as focusing on conventional financial analysis and business planning, ESGI factors are also incorporated into our investment philosophy. Proactive involvement and support around ESGI concerns, integrating them into commercial investment processes, ensures consistent focus on ESGI and contributes to real double bottom-line returns for our clients.

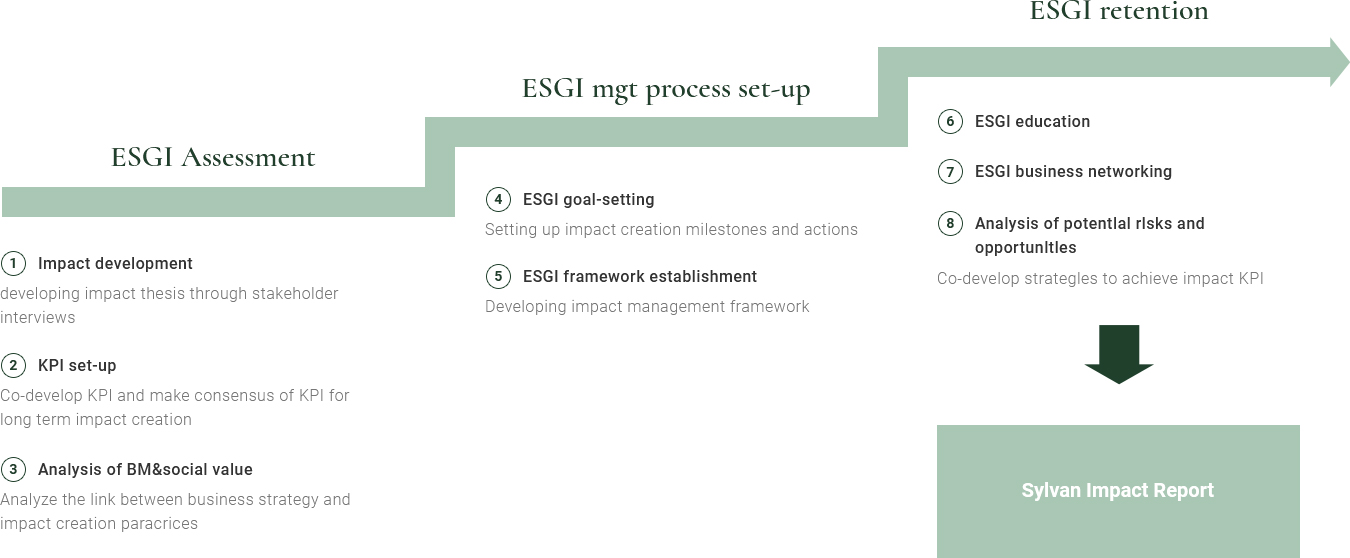

We incorporate ESGI factors into our investment process to different degrees depending on the type of fund (e.g., Article 6 funds versus Article 8 funds under SFDR) and classification of deals (e.g., according to the degree of importance of ESG in the deal). The ESGI integrated investment process below represents the strictest, most formal process of classifying main purpose deals under Sylvan’s Article 8 fund.

01

Pre-investment Phase

Initial Screening: Focuses on growth potential with positive environmental/social impact

- Sylvan focuses on industries and companies where we see strong growth potential and environmental-social impact along with our investment themes (Climate and Environmental Action, Inclusive Growth, and Innovation for Sustainable Life) and UN SDGs.

- Another primary function of the pre-investment screening process is negative screening. It helps the investment team avoid investing in or financing companies that cause significant environmental or social harm.

ESGI Assessment: Due diligence for ESG and environmental/social impact assessment

- Target companies go through an initial screening process. They are then further scrutinized under a DD process to assess their management of ESG issues and impact potential through international standards.

- Sylvan uses value chain issues screening as well as environmental/social impact potential assessments, and ESGI assessment questionnaires & a rating system during the assessment process. We have our own assessment methodology to evaluate environmental/social impact potential, identifying ‘impact identification’, ‘impact thesis’, and ‘impact verification’. These leverage international standards such as IMP, IRIS+, and 3PL analysis. ESGI rating and risk assessment are done through Sylvan’s ESGI DD questionnaires and management interviews. DD questionnaires are directly aligned with the MSCI ESG Industry Materiality Map, selected for corresponding sub-industries.

- Findings from the DD process, including ESG-related risks and/or opportunities, are subsequently presented to the investment review committee for discussion and consideration.

- Upon completion of the assessment, the Investment Committee thoroughly reviews the result and will ultimately propose suggestions to the portfolio management team.

Sylvan’s Impact Assessment Methodology

Our Impact Assessment consists three steps

- Impact Identification

-

key Questions

- Do we have an impact?

- What is our impact?

- What is the social problem we are trying to solve?

- What solutions do we have?

Framework/convention

- 3PL Analysis

- 3PL(Problem/People/Product) analysis enables us to identify the social problems we are trying to solve and our solutions

- Impact Thesis

-

key Questions

- How can we define our impact?

- How can we measure our impact?

Framework/convention

- IRIS+. SDGs

- Impact thesis includes impact statement, objectives, outcomes, indicators, which enables us to clarify impact concretely.

- Impact Verification

-

key Questions

- How to prove the impact we are creating?

- Do we generate enough impact?

Framework/convention

- IMP

- Verifying our assumptions using company data and evidence-based research ensures that we generate enough positive impact.

- We identify social and environmental impacts with an impact thesis and quantify them through IMP and IRIS+ standards, concretely verifying the potential impacts our portfolio company can contribute to our goals.

- After impact verification, we conclude the impact assessment potentials with 3 categories: “Act to Avoid Harm,” “Benefit People & Planet,” and “Contribute to Solutions”, and encourage our target companies to maximize impact potential by providing various tools and support.

- Sylvan assesses the ESG risks and opportunities, leveraging global ESG-related standards and initiatives. If the ESG risks identified during the DD process are manageable over time, we allow our investment team to proceed the investment.

Sylvan’s ESG Risk Assessment System

| Score | High ESG risk (ESG-related risks cannot be mitigated to a satisfactory extent) | Significant sustainability risks identified, but the level of risk remains overall low or medium | Low to medium ESG risk |

|---|---|---|---|

| Details* (ESG rating) | Significant issues identified (More than 5 gray color ratings at ESG DD questionnaires) | A few major issues identified (1~5 gray color ratings at ESG DD questionnaires) | No major issues identified (No gray color rating on ESG DD questionnaires) |

| Action | The investment will not proceed | A clear ESG risk mitigation strategy with a timeline and action plan may be requested as a prerequisite for investment, and regular progress updates reporting | The results of the ESG due diligence are included in the Investment Memorandum presented to the Investment Committee, and shared with portfolio company executives |

- If Sylvan is confident that the sustainability risks identified during the DD process are acceptable or manageable over time, and ESGI potential is sufficient and well-aligned with UN SDGs, we may proceed with the investment with a strong belief in the achievement of a double bottom line: financial returns and impact realization.

ESGI Planning & Risk Management: Management planning including ESG and impact implementation

- Before finalizing an agreement to become part of our sustainable investment fund, we set KPIs to be reached during ownership. We also measure and manage the recommended actions to follow an agreed monitoring plan.

- We actively contribute to the portfolio company’s ESGI transformation. Following a successful investment decision, we continue to work closely with the portfolio company’s management teams to guide ongoing ESGI assessment and supervision. Here are some ways we do that:

- Help establish a baseline for ESGI performance, regularly monitoring impact KPIs and major ESG indexes.

- Develop ESGI targets and action plans to mitigate key ESGI risks

- Leverage opportunities for sustainable value creation

- Conduct periodic interviews, on-site visits and management seminars to help portfolio companies reach their established impact creation goals

- Provide investors with updated annual impact reports

Investment Agreement: Consensus build-up

- As a socially responsible fund, Sylvan continues in an advisory capacity to help prepare for the sale of the portfolio company and eventual exit. We conduct an ESGI reassessment and embark on a partner build-up operation. We confirm the magnitude of impact and ESG at the operational level and seek suitable partners that understand the importance of ESGI realization.

THE SYLVAN GROUP ETHICS PLEDGE

A Commitment to Ethical Business Practices

Corporate sustainability starts with a company’s value system and a principles-based approach to doing business. This means operating in ways that, at a minimum, meet fundamental responsibilities in the areas of human rights, labor, environment and anti-corruption. Responsible businesses enact the same values and principles wherever they have a presence and know that good practices in one area do not offset harm in another. By incorporating the ethical principles into strategies, policies and procedures, and establishing a culture of integrity, companies are not only upholding their basic responsibilities to people and planet, but also setting the stage for long-term success. The Sylvan Group’s Ethics Pledge abides by the Ten Principles of the United Nations Global Compact(UNGC), which are derived from: the Universal Declaration of Human Rights, the International Labor Organization’s Declaration on Fundamental Principles and Rights at Work, the Rio Declaration on Environment and Development, and the United Nations Convention Against Corruption.

Human Rights

- Principle 1

- Businesses should support and respect the protection of internationally proclaimed human rights; and

- Principle 2

- make sure that they are not complicit in human rights abuses

Labor

- Principle 3

- Businesses should uphold the freedom of association and the effective recognition of the right to collective bargaining;

- Principle 4

- the elimination of all forms of forced and compulsory labor;

- Principle 5

- the effective abolition of child labor; and

- Principle 6

- the elimination of discrimination in respect of employment and occupation.

Environment

- Principle 7

- Businesses should support a precautionary approach to environmental challenges;

- Principle 8

- undertake initiatives to promote greater environmental responsibility; and

- Principle 9

- the effective abolition of child labor.

Anti-Corruption

- Principle 10

- Businesses should work against corruption in all its forms, including extortion and bribery.

- Date

- (DD) / (MM) / (YYYY)

- Company Name

- (Name)

- Chief Executive Officer

- (Name) (Signature)

*This pledge is irrelevant to formal UNGC participation.

02

Post investment phase

Engaging and Monitoring Process: ESGI management

- Following the investment decision, the Sylvan team will monitor impact KPIs and major ESG indexes with implementation status on a regular basis. Periodic interviews, on-site visits, and management seminars will help portfolio companies reach their established impact creation goals. Furthermore, investors will be updated with an annual impact report

- Not limited to ESGI assessment and supervision, the Sylvan team actively contributes to the portfolio company’s ESGI transformation. The team will work closely with the portfolio company’s management teams to set up a baseline for ESGI performance and develop ESGI targets and action plans to mitigate key ESGI risks and/or leverage opportunities for sustainable value creation.

Contribution to portfolio company’s impact realization

What

What-

- What outcome(s) do business activites drive?

- How important are these outcomes to the people (or planet) experiencing them?

Who

Who-

- Who experiences the outcome?

- How underserved are the stakeholders in relation to the outcome?

How Much

How Much-

- How much of the outcome occurs across scale, depth, and duration?

Contribution

Contribution-

- What is the enterprise’s contribution to what would likely happen anyway?

Risk

Risk-

- What is the risk to people and planet that impact does not occur as expected?

Exit Process: ESGI reassessment & Partner build-up

- Before the sale of the portfolio company, Sylvan confirms the magnitude of impact and ESG at the operational level and looks for partners who understand the importance of ESGI realization. We will continue to build up ESG and impact for the community in this market.